Bubblicious

As a kid growing up in the 1980’s, there was a brand of bubble gum that was ubiquitous with the time, Bubblicious. It was a sweet, jaw strengthening gum that I loved to chew that would (inadvertently) get stuck into my sister’s hair. This bubble gum also holds the Guinness World Record for the most bubble gum bubbles blown at one time. From that perspective, the Nasdaq is kind of like the market equivalent of Bubblicious. Sweet, exciting and dramatic when the bubble pops. There has been speculation recently if the market, specifically the tech industry fueled by the AI revolution, is in a bubble. There is certainly data to support that asset values are high, but is our asset bubble going to burst?

When asking these questions, it’s always good to go back to fundamentals. In this case, how expensive are we compared to the last big bubble in the 1990’s? Jeremy Siegel, Professor of Finance at the Warton School believes we’re close to becoming pricey but this is due more to earnings growth than unwarranted enthusiasm. Mark Cuban agrees with this cautious optimism and says that the valuation of stocks aren’t what they were back then. If we look at the Price/Earnings ratio for the Nasdaq in March of 2000, it was 175. It was 29.61 on March 19th of this year which would seem to support his observation. The historical average of the Nasdaq is 24.65. This is not the first time we’ve discussed the possibility of inflated markets, you can reference our article Owners, Renters and Micro-Bubbles from June 2021.

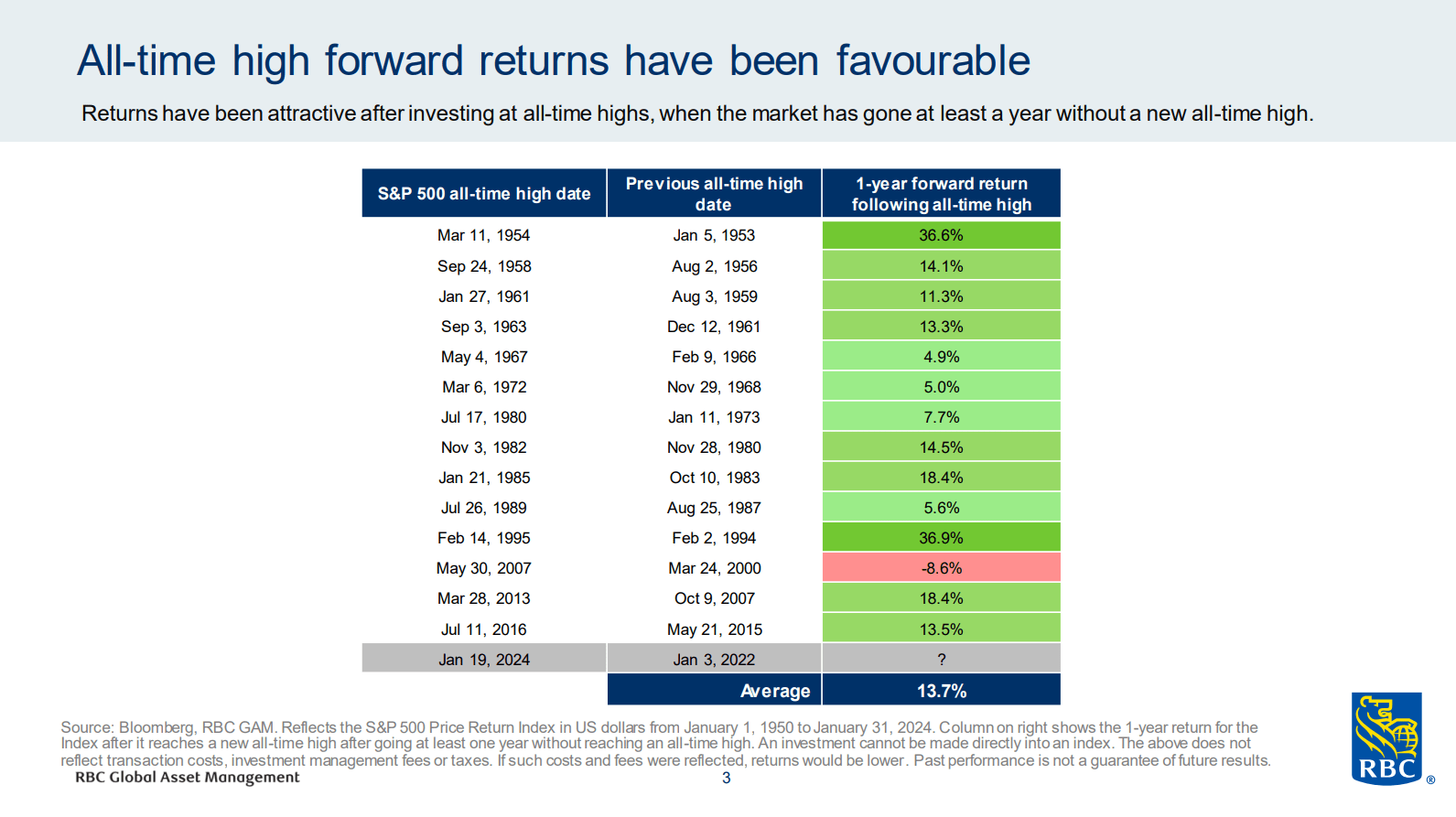

Predictions came as early as 1997 for a dot com crash that didn’t happen until 2000, but if you got out of the market too early you would have missed out on substantial returns. The S&P 500 annual return (including dividends) in 1997 was 33.10 per cent, 1998 was 28.34 per cent and 1999 was 20.89 per cent But in 2000 the S&P 500 was down -9.03 per cent 2001 fell -11.85 per cent and 2002 fell a further -21.97 per cent. There can be strong arguments for passive investing (buy, hold and forget) but if you were planning on retiring in 2000 this might not have been a great strategy given the three years of consecutive declines. The trick to not losing a substantial part of your retirement savings is not to stay in and ignore the markets, but to actively rebalance over time and reduce your risk when assets prices are high but to also reallocate those profits to investments that are out of favour but still fundamentally strong.

We are always trying to find the next investment trend to take advantage of an opportunity and try to avoid getting hit by the next market downturn. Threading the needle however is much harder than it looks.

All-time highs in the market are common but be cautious when everyone is greedy. This is why we’re big believers in buy, hold and rebalance. This allows you to stay in a market that is running while still enjoying returns that an arguably inflated market provides. In 2022 there was nowhere to hide from market volatility, but in 2023 you could barely lose. 2024 is looking the same as 2023 but this is where you have to careful of confirmation bias. If you are aware of this bias you can adjust for it, read differing opinions, review the data and act accordingly. UBS recently wrote an article called Big Tech Rally on Borrowed Time with both bear and bull cases with solid technical data supporting their thoughts.

I remind investors that you do not have to be perfect in your investment timing with every move because that is impossible. What you try to do is to be directionally correct. Just watch out for the chewed gum left on the sidewalk. No one wants to find themselves in the middle of a deflated bubble.

This newsletter has been prepared by Stephen Maser of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.