The Dark Crystal

The 1982 movie The Dark Crystal was an epic fantasy about an adventure to repair a shattered magic crystal. The world fell into darkness but if the missing shard could be returned, it would heal the crystal, and in turn, the world would become light again. Unlike the movie, there is no magical shard of data to provide perfect clarity when looking into the markets future. Financial professionals are often asked to predict the future (and torture metaphors) with data from the past, however, we are seeing conflicting data, and this makes our path forward hard to read. Let us look into our magic crystal and see if we can find some light.

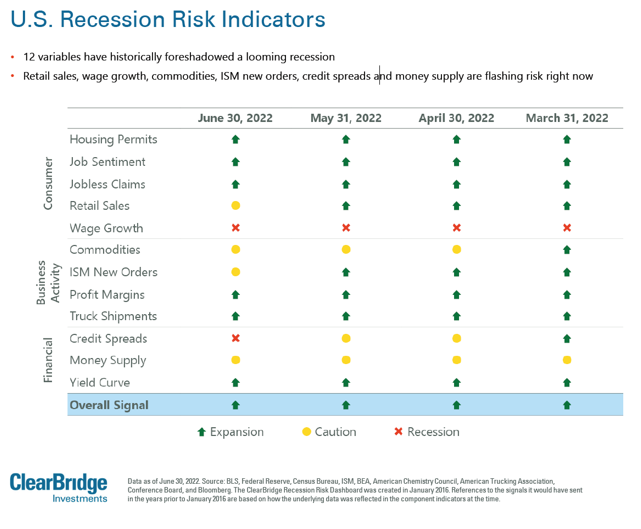

The National Bureau of Economic Research (NBER) defines recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales. Looking at risk indicators for recession, below are 12 variables and things are mixed, but warning signs are showing.

With the exception of 2020, all previous recessions going back to 1970 had either caution or recession indicators lit up across all 12 variables. The Horizons ETF third-quarter 2022 Advisor and Investor Sentiment Surveys reveal bearishness about many asset classes including the loonie, cryptocurrency and fixed income. The majority of economists and analysts we follow believe we’re headed into a recession, and it appears this has been priced into the market. But belief is not always reality, so we must look at the probability. ClearBridge Investments currently has the probability of recession at 55 per cent, so basically a coin flip. It appears that we are on a random walk down Wall Street.

Two truths have held in regards to recessions:

- We’ve never gone into one when interest rates have risen this quickly.

- We’ve never gone into a recession when unemployment is this low.

This information is contradictory and definitely uncharted territory.

Since 1950, bear markets on average last 18 months while the average bull market lasts 54 months with an average total return of 152 per cent. This is not a prediction as to when current markets will stabilize and begin moving up, but it is highly likely we’re past the half-way point and the light will soon emerge. Most importantly, it’s always best to stay in the market, especially during volatile markets. Some of the largest market returns tend to happen the first 12 months following a market correction or crash. The median pullback in both recessionary and non-recessionary bear markets is -15.6 per cent (-17.23 per cent YTD as of the time of writing). Keep in mind that the average one-year forward return is 40 per cent once stocks have found their low during a recession. It’s also good to remember that stocks tend to bottom several moths before a recession is over and often when we hit peak pessimism and all headlines are negative.

The general consensus is showing economic weakness will likely be relatively mild. Corporate balance sheets are not over-extended, supply has had difficulty meeting demand, and banks are very well capitalized. As time goes on, the darkness of the crystal clears as data becomes better and the direction of the market is more obvious. Aura’s advice is to not leave the market or try to time a bottom. You run the risk of missing the recovery.

This newsletter has been prepared by Stephen Maser & Joe Howorko of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.