Is Following Money Prophetic?

People have been trying to predict how to make money and the direction of markets for as long as there’s been tulips to buy. When times are good, no one really questions things as long as their money grows, however this changes when you see your net-worth drop. Market cycles are inevitable due to the psychology of investors, so we have to be aware of this when making choices with our investments. At this point, everyone knows we’re in a market correction and the questions that are asked the most is when does it end and what do we do?

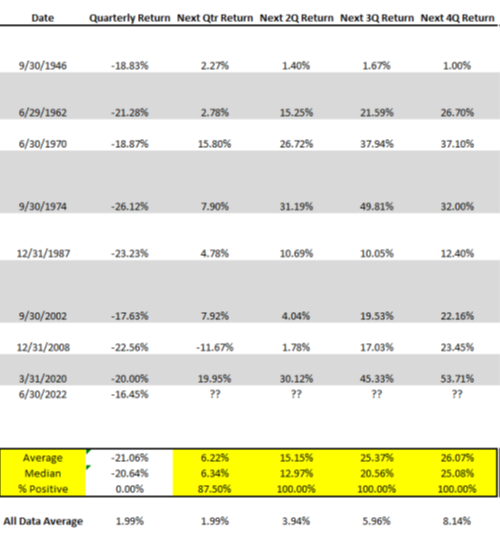

First, when does it end? Typically in a bear market a recovery the pattern looks like a “W”. While we did see a V-shaped recovery during the Covid lock-down, this type is rarer. With a W-shaped recovery you see the initial drop, a bear market rally, a retesting of lows and then an eventual, sustained increase of prices. We believe we’re at the retesting stage, which is about two-thirds of the way through the pattern, but the timescale is harder to judge. We could start to see the recovery tomorrow or 12 months from now. Let’s take a look historically at how markets have reacted to a -15% quarter. This data is from Raymond James Ltd. September 20th weekly market recap.

With an average return of 6.22% in the next quarter after a 15% or more drop in the market from the previous quarter and an average of 26.07% in 12 months, this is a strong argument to stay invested and not to overreact. This gives us hope that recovery might be close and the opportunity for those of us with cash on the sidelines to deploy when asset prices are cheap. If given the opportunity, who wouldn’t want to own a Ferrari at Toyota prices? While this generally looks positive for returns going forward we still have to remain cautious as short-term volatility can hurt a portfolio if one gets too aggressive.

The second question is what do we do? This might be an easier question to answer, at least in theory. Everyone knows you should buy good assets and hold them for the long-term, but let’s try and define what a good investment is.

Elon Musk just acquired Twitter for $44 billion and is taking the company private. As of November 1st Twitter has debt of about $13 billion with annual interest payments of $1 – 2 billion annually. This is a company with annual reported revenue of $1.18 billion in June of 2022. This is not a commentary on Musk, which has been articulated best here, but more on the state of Twitter’s business. Does it make sense to purchase a company for 44X that of its earnings? Over at Meta (formally Facebook), CEO Mark Zuckerberg has invested more than $36 billion since 2019 into designing its own metaverse and is doing so at a time the company is seeing a drop in revenue for the first time in its history. Does it make sense to put such a huge investment into something no one is sure they want? Time will tell whether these are good investment decisions for their owners but most of us do not have the luxury to take outsized risks with our money.

A good place to start is to ask where market recovery’s typically starts. While there are no fully recession-proof stocks, sectors like consumer staples (Home Depot, Walmart), health care (Johnson & Johnson, Pfizer) and utilities (Fortis, NextEra Energy) have historically done better. A focus on dividends also matters as blue-chip stocks tend to recovery quicker, you also get paid to wait as the market finds it footing again. Looking at technically attractive stock charts for the week of November 1, 2022, all the companies were either healthcare, commodities or hard-asset companies.

Coming back to Twitter and Meta; advertising businesses are not the type of companies that recover quickly. Advertisers tend to spend less in a recession which directly impacts the majority of Social Medias revenues. Musk and Zuckerberg might be smart, but the kind of math that is working against these two men is very ominous. As investors, biases can be our biggest hurtle to coming to a positive outcome. To be successful investors, we need to follow the money. Households are looking for deals in groceries (Walmart), people still need healthcare (Pfizer) and with winter coming, most will find ways to pay for their central heating (Fortis) before paying $20/month to Twitter for a blue checkmark.

We picked on Twitter and Meta because they were easy targets but also because they illustrate our point. Keeping focused on the long-term and quality investments will carry investors through recessions when they happen and losses can be less than that of the broader market. Small adjustments to portfolios during recessions can generate strong returns as we move closer to an inevitable recovery.

This newsletter has been prepared by Stephen Maser & Joe Howorko of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.