The Iceberg Illusion

Image Source: theladders.com

Most people are aware of the illusion of an iceberg, in that you can only see about 10% of its total volume and the remaining 90% is hiding below the water’s surface. This has often been used to illustrate that what is obvious is only a small part of a larger, unseen issue. The iceberg I’ve been thinking about is the tariff iceberg floating through the global economy, and what’s been surprising is that its effects have been largely ignored by the markets.

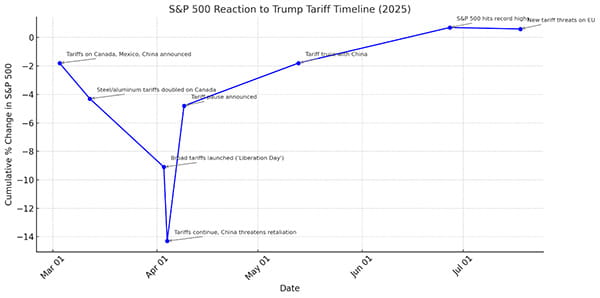

It’s true that we saw a lot of volatility at the beginning of the year, but we’ve since recovered, and markets are flirting with all-time highs. This may be partly because of what’s come to be known as the TACO trade. The result is that ongoing threats from the Trump Administration create smaller reactions from the market. Tariffs are announced, then get rolled back, only to be put back on again. The administration claims that deals have happened or are imminent but there is no evidence of such deals, and the market shrugs its collective shoulders. There is also the possibility that the lack of market reaction could embolden the Trump administration to take a more aggressive tariff posture, continue to threaten Fed Chair Powell’s job or just generally be chaotic because the markets aren’t reacting in a way we’ve come to expect. This short-term thinking can only last for so long before economic reality asserts itself. And the market reaction, when it does react could be larger than expected.

This has been shown with the initial drop in the S&P 500 at the beginning of the year. On March 12, Trump doubled his initial 25% tariffs on Canada and Mexico to 50%, and the S&P 500 entered correction territory. On April 2, the so-called Liberation Day, the S&P dropped another 4.8%. China retaliated on April 5, S&P dropped ~6% only to have Trump blink and remove tariffs on April 9 and the market rips up+9.5%. As this on-again, off- again cycle continues, the market reaction lessens and leaves us with the false sense of security that whatever Trump is doing is working (or not making things worse).

Source: Wikipedia (US and Canada), Wikipedia (2025 Stock Market Crash), The Gaudian, AP

This, however, is only 10% of the economic iceberg we see, and the investment market is not the economy, especially when you look at the short-term. Stories of businesses getting caught up in this have gone largely unreported. One story is that of a U.S. import business that had a shipment of merchandise from China unable to dock at the Port of Los Angeles as they needed to find millions of dollars to pay the import tariff just to unload the shipping container. The business owner then had to find a small army of people who could get into the container and re-price the entire shipment as Chinese merchandising is sophisticated enough to price products at the factory before shipment. Another example is that of a Canadian company that tried to get ahead of the initial 25% tariff at the beginning of February, but the shipment was caught at the border due to the backlog as other businesses were trying to do the same thing. Unfortunately, the shipment was charged the 25% despite their efforts and prices could not be adjusted after the fact. The result is: business owners are not sure what to do. No proactive business planning can be done, new hiring doesn’t happen, and raises for workers are postponed.

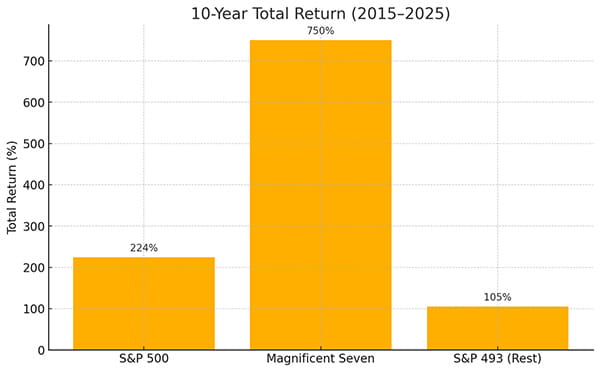

Another element of the 10% problem is that markets are dominated by big tech, who are largely not affected by tariffs in the same way smaller companies are. They are global in nature and dominate the S&P 500. As of May 2025, the Magnificent Seven accounted for 34.1% of that index. With this sort of overweighting, we must ask ourselves how did the other 493 companies do?

When looking at this, it seems like the iceberg has turned over and is showing us the 90% below the water but this is also an illusion. According to the U.S. Bureau of Labor Statistics, less than 1% of the total U.S. workforce is employed by the Mag 7.

So why is this not currently being felt in the investment markets? A possibility is the delayed nature of economics. What is happening now will not show up in the data until later but there are early warning signs. The New York Times reported that data from the Labor Department was showing price increases in toys and appliances, and consumers have started to pull back spending. Economists at Pantheon Macroeconomics expect 30% of the tariffs’ impact to hit by July; and 70% by October. This forecast also assumes there won’t be any more tariffs and there won’t be a recession. We are also feeling the effects of frontrunning to avoid the tariffs previously mentioned. This means that the surge in spending at the beginning of the year will result in less spending later in the year as consumer needs are sated.

Once we see the effects begin to show up in the data, and more importantly, are felt in the real world, we will very likely see the market react. This is why not reacting to every headline (10% of the iceberg) and keeping an eye on the long-term trends in the economy (90% of the iceberg) will help avoid a lot of financial harm and why our rebalancing efforts were implemented slowly and cautiously in the first half of the year. Watching the data come in allowed us to navigate around potential dangers, like companies overexposed to tariff and recession risk. We added to Canadian positions and increased international exposure outside the U.S. to reduce potential volatility.

It’s also worth mentioning that valuations are high, especially in the U.S. market. As of July 21, 2025, the S&P 500 was trading at a P/E of 25.9x; its 10-year average is ~19x. Compare this to the MSCI EAFE (developed ex-U.S.) which is currently 17.03x; its 10-year average is 14.55x. The MSCI EAFE, while still slightly more expensive to the average, is much closer to being fairly valued compared to the S&P 500. Caution remains prudent and our cash and equivalents remain overweight in relation to the rest of the portfolio. Remember, if you can’t avoid the iceberg, you don’t have to run full steam ahead into it.

Image Source: Paramount Pictures

This newsletter has been prepared by Stephen Maser of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.