The Circle of Life

Image Credit: Disney Pictures

I remember being introduced to the concept of the “Circle of Life” from the movie The Lion King, embodied by the song of the same name. The idea is a philosophical and biological concept representing the interconnected, cyclical nature of existence – birth, growth, death, and renewal. This reminds me of market cycles, our own financial circle of life.

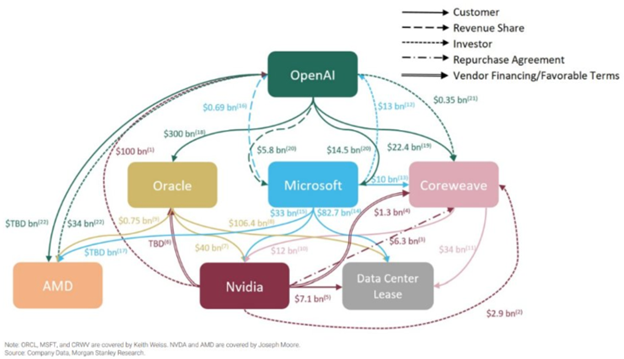

There is another circle of life that is starting to emerge, or in this case a circle of money. We are starting to see some late-stage market cycle activity, something Ed Elson, host of the Prof G Markets podcast calls the “circular deal theory”. Simply put, big AI firms are deploying money with each other, but that money never leaves the circle. Gil Luria, Head of Tech Research at DA Davidson spoke on the September 24th episode of the podcast about this phenomenon.

Recently, Nvidia announced investment of $100 billion in Open AI, which Open AI will then spend on Nvidia’s GPUs. It goes out the door as investment, then comes back as sales. A perfect circle of money; you fund your customer, and in turn, you guarantee your demand. This is concerning and becoming more commonplace. Microsoft invests $13B in Open AI and then, Open AI buys $10B in compute from Microsoft. Amazon invests $8B in Anthropic and then Anthropic turns around and buy Amazon’s compute. Google invests in Anthropic and then, Anthropic buys Google’s compute. And these are only a few examples. Elson goes on to say, “These are all pitched as investments but as you dig deeper, the money is all going in the same direction… a circle. And the circle is surrounding the same small circle of players. You deploy the capital, you collect the revenue, you watch the stock go up, but the money never leaves the circle. We’ve seen this before and everything is fine until the music stops, but when it does, it gets ugly fast.” My wife Laura compared this to musical chairs, and we all know how aggressive the last two players can be in that game.

Our team was recently in Montreal at Canoe Financial’s annual CEO Series conference and there were several takeaways. Rob Taylor, SVP & Chief Investment Officer of Canoe said there are valuation gaps between the most crowded stocks and the rest of the market. Look back at our last quarter’s article, The Iceberg Illusion, where we illustrated the overweighting of the Magnificent Seven companies compared to the rest of the S&P 500. These valuation gaps are widening, creating attractive entry points. Rob also points out that in concentrated markets, history suggests that following the crowd is a losing strategy for long-term investors. And finally, the challenge and opportunity going forward is balancing the allure of mega-cap momentum with the discipline of diversification and re-focusing on fundamentals.

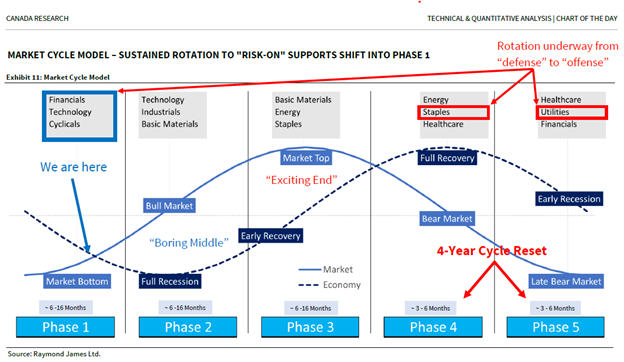

Raymond James equity research analyst Javed Mirza has been pointing out for several weeks that the technical market indicators are showing a new four-year cycle reset, that money appears to be moving from paper assets to hard assets and should run for about two years, or at least into the first half of 2027. This might seem like a contradiction when worrying about a potential asset bubble, as I mentioned earlier in AI and tech. Reread our article Bubblicious, as it touches on sector-specific bubbles inside a relatively strong market.

The four-year cycle reset comes in the form of five general phases, as illustrated above. Javed believes we saw Phase 1 (Market Bottom) in the first half of this year. In Javed’s September 29th technical markets call he pointed out that gold and copper were leading, financials were stalling and that lumber sucked but was improving. He’s bullish on the Canadian dollar long-term and Japan’s currency is stabilizing. All this implied the earlier claim of the rotation into hard assets.

The circle of money, whether it’s localized in tech or more general with money starting to move to industrials, basic materials or other places globally, can leave you feeling dizzy due to the complexity at play. If you’re feeling confused, wondering if we’re going to continue seeing the market go up, or experience a recession and a market crash, or something in between, you’re not alone. One of the problems with market bubbles is that you never know when they’re going to pop. The Economist had predicted the dot-com crash in the 1990’s but they were about two years too soon. This is why you never leave the market entirely because if you listened to The Economist, you would have missed out on two years of double-digit return. We continue to own several Mag 7 companies however we’re never scared to take profits when they present themselves and find other companies at more reasonable prices in other parts of the global economy.

Predicting the future is often wrong and some of the predictions in this article might be also. This is why you stay diversified, rebalance regularly and stay in the market.

This newsletter has been prepared by Stephen Maser of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable, but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for, nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.