The Two-Faced Market

Researching market data right now reminds me of Harry Truman’s famous quip, “Give me a one-handed economist. All my economists say ‘on one hand…,’ then ‘but on the other...” Here we are in 2023, looking for guidance from the markets, and it feels like everyone is pointing in two different directions. To make my point, while doing research for this article, I read two articles from the same research firm saying two different things about the same topic on the same day. This kind of schizophrenic writing increases in times of high uncertainty. The likelihood of being wrong can have the same odds of a coin flip. Will we go into recession? Will the dollar rise? Will the price of oil fall? All financial professionals can fall into this trap, so it’s useful to look at history as a guide.

Since 1950, after a yearly decline, the S&P 500 is higher 84 per cent of the time. In the following year after a decline, we have seen average gains of 15 per cent. We’ve already seen a strong improvement in returns compared to last year, but at the risk of showing a second hand, we’re early into the year and caution is always prudent.

On the economic front, RBC Global Asset Management reports Canada’s manufacturing sector expanded at a moderate pace in January, underpinned by stronger production and new orders. This was the first time the S&P Global Canada Manufacturing PMI increased above 50 since July 2022. This shows a potential expansionary trend with companies reporting an increase in productivity and labour markets showing signs of stabilizing. Capital Economics wrote in their February 7th daily newsletter that the fall of credit spreads in the U.S. is a clear sign that the economy is heading for a soft landing.

Source: FactSet

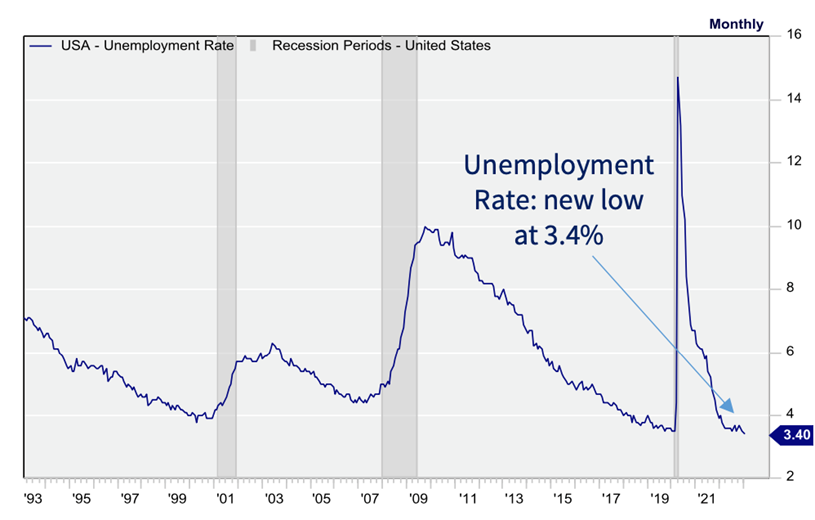

The U.S. added 517,000 jobs in January versus the 185,000 expected, and Canada added 150,000 jobs, which is 10 times what was expected.

Source: FactSet

On the proverbial other hand, manufacturers’ confidence remains low and they continue to maintain a cautionary stance on purchases and operations. In the near-term, the stock market looks overbought and volatility has not gone anywhere.

We continue to favour overweighting cash and equities while underweighting fixed income in our portfolios, picking good companies at reasonable valuations and not indexing. There are reasons to be hopeful that we are past the worst in the medium-term but portfolios need to be nimble and unless you won’t look at your investments for 10 years or more, passive investing in these markets can be hazardous.

In ancient Roman religion and myth, Janus is the god of beginnings, transitions, time, and duality and is usually depicted having two faces. January is named for Janus and is said to have presided over the beginning and ending of conflict. I can’t help but think that Janus would be the modern patron saint of economists.

This newsletter has been prepared by Stephen Maser, Joe Howorko, Dale Krushel & Amanda Krushel of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.