Jumping to Conclusions Is Terrible Exercise

I’m sure many of you have heard of the recent firings of Tucker Carlson from Fox News and Don Lemon from CNN. Many wonder where these two will end up and how Fox and CNN will survive without them. Scott Galloway, whom I’ve referenced many times in the past, has pointed out that the platform is almost always stronger than the personalities the platforms hosted. And the news continues to march on without them.

My point is that these platforms are very powerful and carry massive sway over opinions, and no one individual (with the possible exception of Rupert Murdoch) can dent the impact they have. This is true of the retail investor’s reaction to the markets, which in turn reflect a reaction to the news. It’s a domino effect. But what is more important than the news is knowing how to react to the market’s reaction of the news. In many cases the best advice is to do nothing, especially when information is fresh and less than perfect. When I worked in the oil industry, there was a running joke that if no one moved, no one gets hurt. The same follows investing: when in doubt, do nothing.

A good example of this is the recent collapse of Silicon Valley Bank (SVB). I was speaking to a client about the fallout of this event and the possibility of an ongoing banking crisis in the U.S. He was concerned of what the collapse of SVB and the possible contagion might have on other mid-tier banks in the U.S. and across the globe. Our position in J.P. Morgan (JPM) was of particular concern. While his concern is understandable, by the time the news has been reported, the markets have already reacted, and it’s too late to do anything meaningful.

As it turned out, there was little to worry about. The capital requirements for a bank the size of J.P. Morgan are far stricter than for a U.S. regional bank, and there was little risk of a bank run on JPM like there was on SVB. When SVB collapsed on Friday, March 10, 2023, the stock price of JPM closed at $133.65 USD, up 2.54 per cent. Since that date JPM released its 1Q23 results on April 14, 2023 and the stock closed at $138.73, moving up approximately 7 per cent. It then acquired First Republic Bank as a direct result of the banking crisis on May 1, 2023, closing at $141.20, up 2.14 per cent. As of this writing the stock is up 11.94 per cent year-to-date. We have to remember that this is all short-term price action and reactions to news tends to be oversized compared to the long-term prospects of a business, both good and bad.

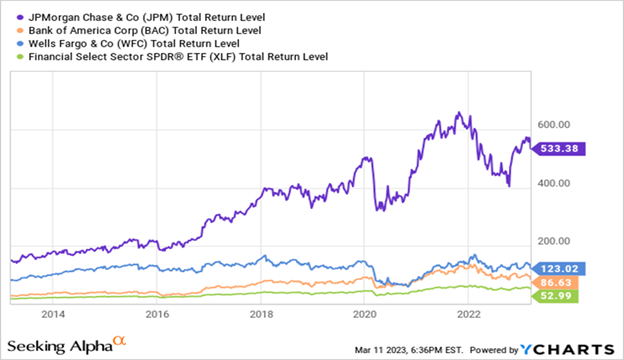

I don’t want to imply that we’re oracles in money management, because we aren’t, and we certainly can’t see the future. But what we do very well is remain disciplined, especially in the face of volatility and uncertainty. We chose JPM as a part of our portfolio not because we saw the future, but because it is an exceptionally well-run business and on a risk adjusted basis, it was more likely to weather a storm better than many other banks. Seeking Alpha goes into detail with their March 13 article.

This logic is applied to all our positions. And when we’re wrong (every investor is eventually), our mistakes are not so large as to collapse the portfolio or derail a client’s financial future.

This all relates back to the news. Many have heard me call the financial news financial pornography. It’s designed to grab your attention, get you excited about whatever they’re talking about and then make you engage in FOMO if you’re not a part of the narrative. The issue with these news outlets is that while the platform is strong and attention grabbing, it does little to deepen your relationship with your money, only to make you feel isolated from it when it acts in a way you feel it shouldn’t.

This newsletter has been prepared by Stephen Maser, Joe Howorko, Dale Krushel & Amanda Krushel of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.