The Prophecy of Economic Cycles

I’m sitting at my desk writing our teams latest newsletter, weeks of research in hand, ideas flowing and my pithy commentary ready to wow readers… and poof, it’s gone. Years with a computer, paranoid about losing my work, so used to hitting the save button every 30 seconds and the computer gods decide to remind me how little I control. I certainly wouldn’t have predicted that a 40-year-old computer program would have decided to have a mental hiccup.

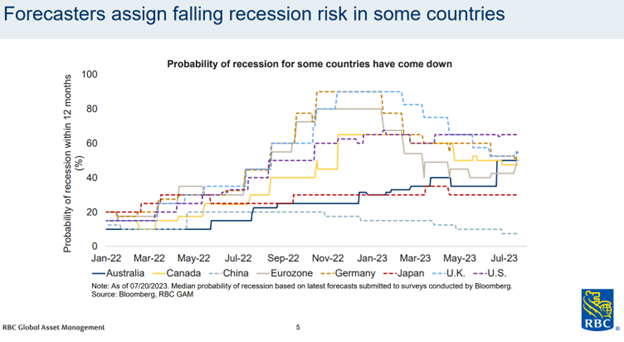

Having dinner with a friend recently she asked if I thought a recession is coming. We have to remind ourselves that with economic cycles, a recession is always in our future. But what she was asking if one was coming soon, like in six to twelve months. She was also looking for a definitive yes or no answer. I replied that I thought there’s a 20 per cent chance of a recession. Now, I have no scientific formula to back this up, only a broad consensus of economists, analysts and industry experts who all have a different take on this prediction. We also have to remember that predictions are probabilistic, not binary. Therefore, based on my experience and the opinions others, therein lie my prediction. However, when looking at the chart below, the average seems to be higher than that in most countries.

Let me justify my prediction. Economists tend to be a conservative lot. They scour over data, look at history and make forecasts about what the future might look like. There’s an old joke that economists have predicted 9 of the last 5 recessions. Or if you ask an economist how has the French revolution affected world economic growth, they’d tell you it’s too early to say. Joking aside, if you go back to our blog post from July 26, 2022 we showed a chart of U.S. recession risk indicators. Six of twelve of those indicators were flashing yellow or red and at least three more have started to give warning signs. But we also mentioned two truths about recessions. We’ve never gone into one when interest rates have risen this fast nor when unemployment was this low. And of those twelve indicators, jobless claims are still flashing green.

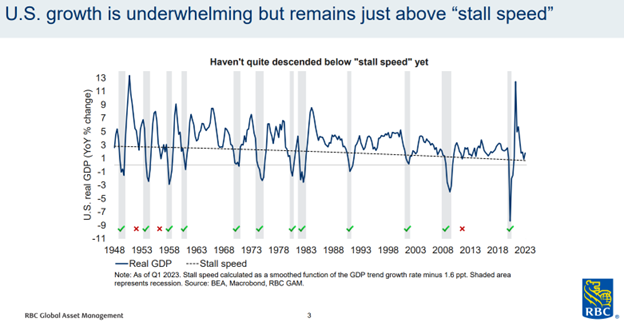

Let’s take a look at the “stall speed” of the economy. While it has certainly slowed, the chart below is showing a small, but noticeable recovery in GDP growth.

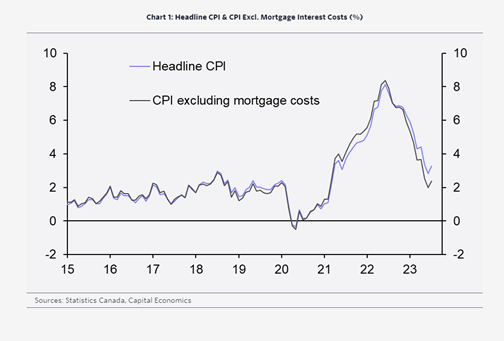

Inflation has also come down almost as fast as it went up. Let’s go back to my 20 per cent chance of recession prediction. Given this data, the conservative nature of economists and the very sketchy practice of prediction, central banks may have done the near impossible and threaded the needle of a soft landing. Time will bear this out, and there is no such thing as zero probability, but when people have exited the market in hopes of timing a downturn, they’ve often missed out on the best days in the market.

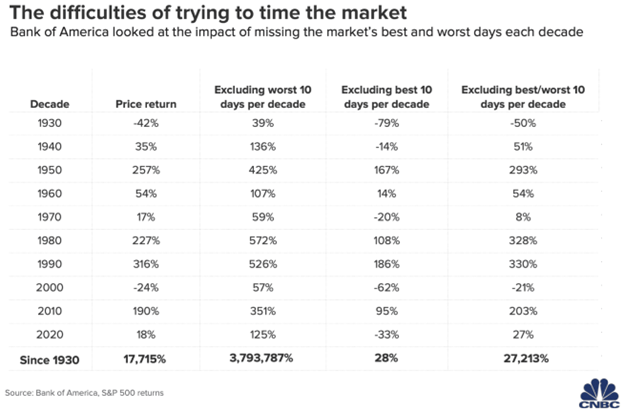

Looking at data going back to 1930, Bank of America found that if an investor sat out the S&P 500’s best 10 days per decade, total returns would be significantly lower than the return for investors who waited it out. My point is that regardless if we go into a recession or not, discipline is key. And if you find yourself off in your timing, stay disciplined in your approach, manage your risk and stay in the market. Economists may have been around a lot longer than Microsoft Word but their crystal ball is as cloudy as it was during the French Revolution.

This newsletter has been prepared by Stephen Maser, Joe Howorko, Dale Krushel & Amanda Krushel of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.